Trend following is the safest and is the most popular trading strategy among traders in the world. The idea here is to ride the current trend in selected time frame with hidden divergence confirmation. The following indicators are needed:

- MACD (default setting)

- EMA 50

- Stochastic oscillator (default setting)

Entry rule:

- When price is above the 50 EMA, we only go Long. When price is below 50 EMA we only take Short position.

Long entry:

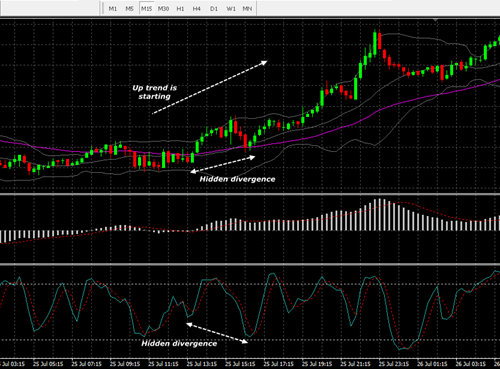

When MACD bars are above the zero line and price is above the 50 EMA, it indicates that the current trend is UP. We try to catch the trend by identifying the hidden divergence on Stochastic. See example below

When MACD flip up, I suggest not to enter Long immediately because some times the price can move down again on the next few bars. Let the price found and start its up trend. Don't worry if we miss few pips.

After the price move up then it must be retrace down. This is the crucial part. Get ready to check and compare the Stochastic. On an uptrend, the price have to make higher low. Check if the Stochastic does not confirm by making lower low. If you found this phenomenon, then hidden divergence is on the way. We can go Long when price hit and bounce on 50 EMA or any resistant area.

Another good ide is to use the trend line breakout to confirm the hidden divergence. See how we open Long on the example above.

It's a perfect setup since the price move up significantly after the hidden divergence. On the next retracement, we still found a hidden divergence. You may find it on the chart above for practice.

0 comments:

Post a Comment