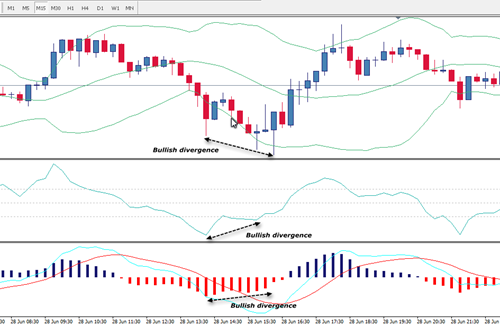

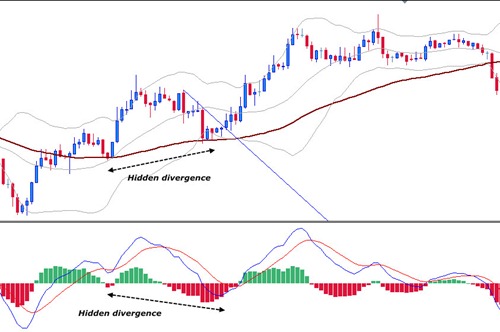

FXSniper T3 CCI is a good indicator if it used with other indicator as confirmation. Actually it's a very nice indicator only if we can read and use it in a good and correct manner. I always use other indicator as confirmation or to support the signal given by this FXSniper T3 CCI indicator. Basically, the T3 CCI buy signal is given when there is crossover from the bottom (red bar) into the green one (green bar). But, for me, its not enough to give me confident to open my trade. So, on this post, I want to show you how to trade using T3 CCI with other confirmation.

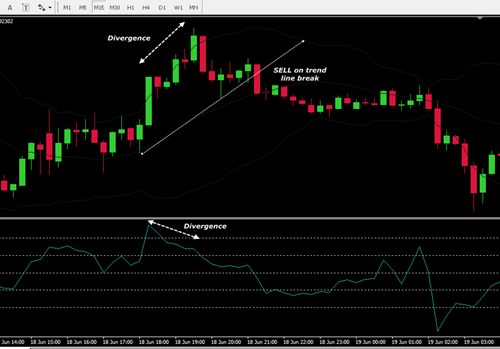

1. FXSniper T3 CCI with trendline breakout

Trendline breakout has been my favorite trading tool. Any indicator will be good for me if it combined with this trendline breakout. T3 CCI also good if we use trendline breakout as confirmation. This method is good for scalping with 10-20 pips on each trade as the profit target. See illustration below.