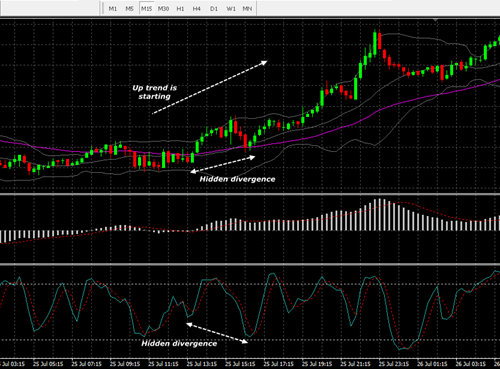

Before you continue to read this post, please note that this is a free signal. Thus there is no guarantee that this signal is 100 percent accurate. This signal is calculated using fibonacci breakout strategy and tested many times. But still, you will need to manage your risk.

Signal for EURJPY, valid until 8 August 2013

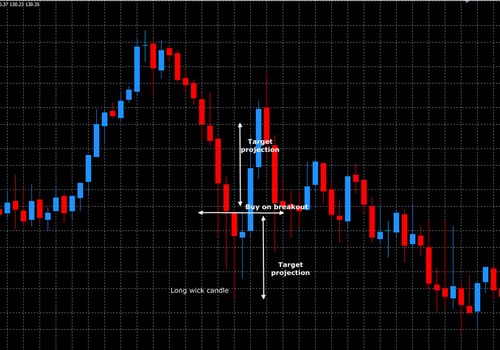

Place a pending order BUY stop with the following details:

Put your stop loss based on your own risk management. Since this is a breakout strategy, it's about 1:1 risk reward ratio. The take profit level can be increased based on todays low of EURJPY (7 August 2013).