I like to trade based on price action with no indicator attached on my chart. I don’t like any indicators on my chart because it makes me confuse sometimes. Now, I am learning to trade based on price action only. And the most price action signal that I love is the long wick/tail candle.

How to trade this long tailed candle?

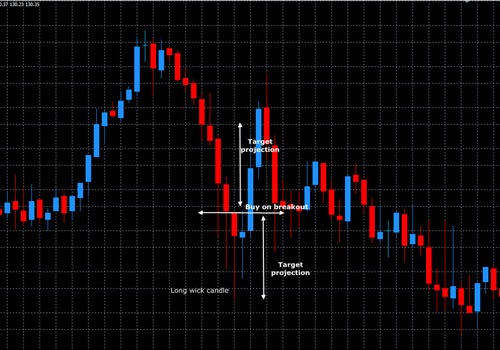

First, spot any long wick candle on selected time frame. H1 is my preferable time frame for this trading system. After we have a long tail candle, prepare to go Long or short based on the candle type. On the example above, we have a bearish long wick candle. On theory, this long wick candle is indicating that selling pressure is weakening and buying pressure is stronger.

Place stop order on the long wick candle breakout. On the chart above, we go long when price break the top of the long wick candle.

Where is our exit and stop loss?

A good trade setup must have its own both take profit and stop loss target. For the take profit, measure the distance from the low of the wick candle to the breakout. That is our take profit. Project that distance and use it as our take profit. The stop loss should be placed on the low of the candle. So, this is 1:1 risk reward ratio.

0 comments:

Post a Comment