Indicator actually formed to mirror the price so, the shape, form and the movement of indicator is based on the moving price. So, why should we believe the indicator if its only mirror the price? Well, on my own experience I mostly use some indicators. But, my trades are not taken based on the indicator only. It's about timing, its about feeling and intuition I guess.

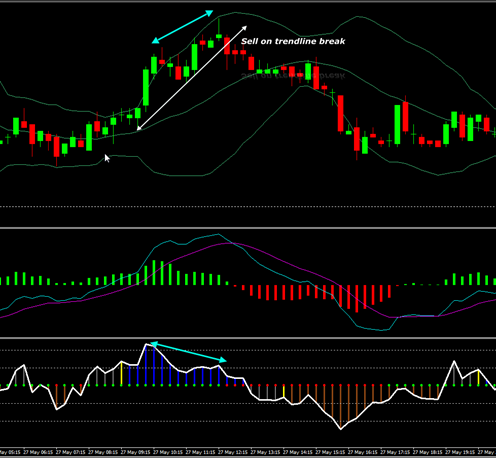

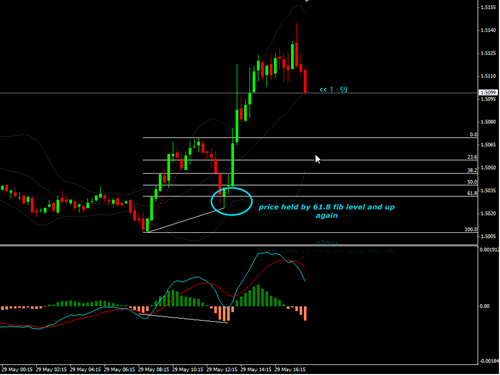

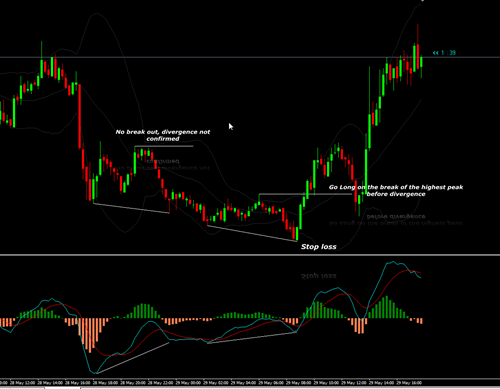

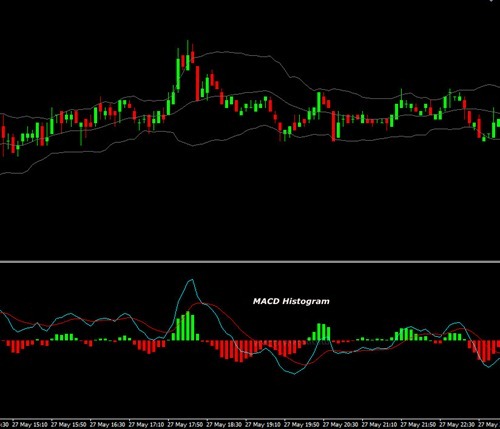

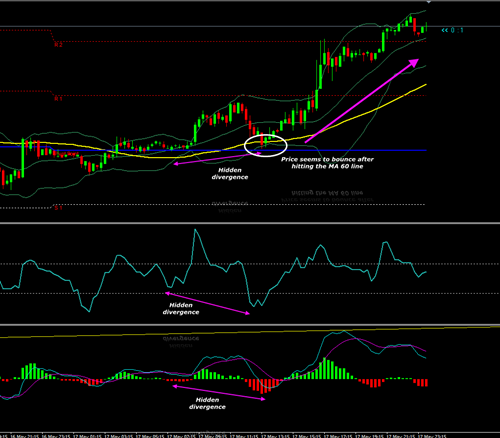

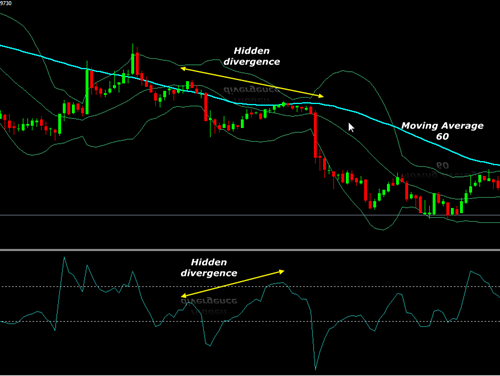

For example, CCI and Bollinger Bands is two indicators that must be present on my charts. I use them to spot divergences, overbought and oversold zone but still the final decision is on myself. Even I saw a clear divergence I will not enter the trade if I don't feel to. It's a bit hard to explain.

Believe me, there is NO perfect indicators in this Forex world. So, if you see any indicator advertisement, any offers that promise 99 percent accurate, I can tell you that it's a BULL SHIT!! Forex is about money, risk and mental management. You only need to learn the basic. And then, improve your self by using demo (even I do not recommend you to use demo in long term). After that, there is no other way to be success in Forex except to get into the real trade, real money.

The more you loss, the more you learn. Do not ever give up. You are failed only when you are give up.