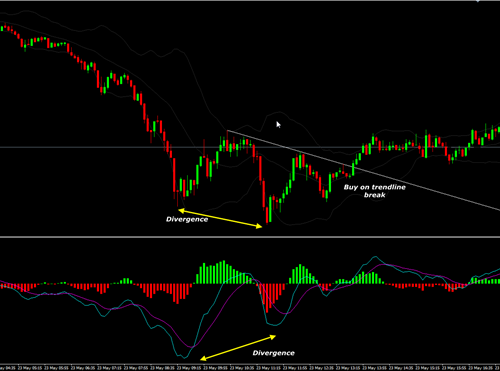

Divergence is a perfect indication to know when the trend is going to end. When we spot a divergence,the price is going to retrace or even make a reversal. But, divergence it self needs a confirmation. And the best confirmation is a trendline break out. When divergence already formed and the price moving to the other side and break the trendline, there is a higher probability the price is going to reverse. See the reversal example below

MACD give better divergence signal compared to stochastic or CCI but it more rare to happen. Maybe only once in a day (M15 time frame). But if the MACD histogram give divergence signal, it's a strong indication that price will reverse.

0 comments:

Post a Comment