Trading divergence is profitable (with less stop loss) and can gain more profit. This post will show you a pretty nice trading setup based on FXSniper's CCI Divergence. FXSniper CCI is a modified CCI indicator. You can download FXSniper CCI from this link if you don't have already.

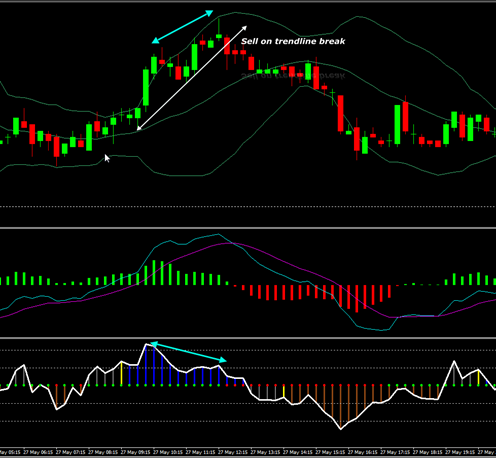

Negative Divergence occurs when price makes higher high but the indicator make lower high instead of higher high.

I always use trendline to confirm the divergence. I always go long or short on trendline break. And the most important thing is to put the stop loss above the previous high. This is important because sometimes divergence can occur several times before the price really reverse. So, protect your account with stop loss.

0 comments:

Post a Comment