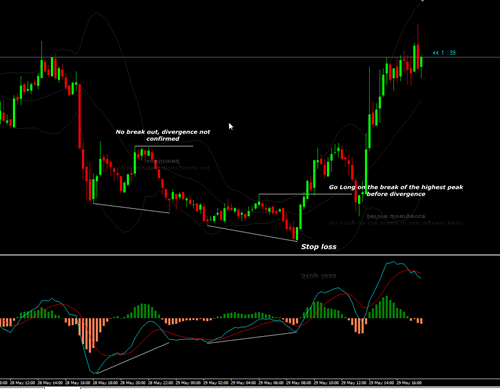

I found a nice setup based on my MACD Histogram divergence breakout on GBPUSD pair on 29 March 2013. There was a nice positive divergence and followed by a nice hidden divergence. Divergence actually happened on any pairs and any time frame but how to confirm it and how to start open the trade is another matter. So, divergence needs to be confirmed first before we take actions.

As you see on the picture above, price made two divergence. As we trade after the breakout, on the first divergence there was no breakout. The price could not break the peak before the divergence. So there was no trade.

On the second divergence, price move up nicely and break the previous peak before the divergence and we use this as the confirmation. As a result, price move up pretty nice. And always put your stop below the previous low.

0 comments:

Post a Comment