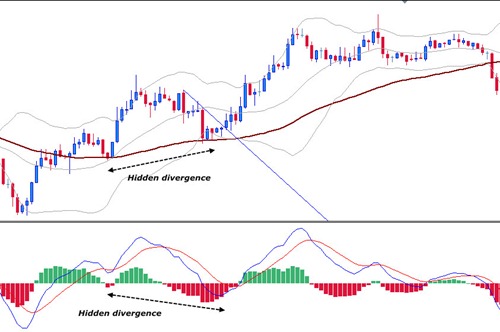

MACD Histogram is a very lagging indicator and always late. That's why I do not recommend to trade using MACD Histogram flip or signal cross over. MACD Histogram is very powerful to detect divergence. Divergence fake out is less when using this indicator. Personally, I prefer to trade hidden divergence on any time frames. Since I am a scalper, I only look for 10-30 pips on each trades I take. Here is the example of the hidden divergence reading using MACD Histogram.

Indicators:

- MACD Histogram

- Bollinger Bands

- Simple Moving Average (60 period)

If we want to trade hidden divergence, make sure there is a clear trend, no matter its uptrend or downtrend. On the chart above, NZDUSD H1 time frame has made a nice uptrend. After making a strong move, the price entering retracement or consolidation stage. At this retracement process, open your eyes and start comparing the price with the MACD Histogram. Make sure to watch only the high and the low.

On the chart above, I compare 2 lows which are making higher low but the MACD Histogram showing lower low. This condition is known as hidden divergence. To enter the trade, we need additional tools such as trend line break out or Moving Average bounce. As you see, the price respect the MA 60 pretty well. Open Long position after MA 60 bounce or when price break the trendline.

0 comments:

Post a Comment